Blockchain technology is rapidly transforming the landscape of cross-border payments, promising faster, cheaper, and more transparent transactions. Traditionally, international money transfers have relied on a complex network of intermediaries, including banks, payment processors, and foreign exchange brokers. This system is slow, costly, and prone to errors. Blockchain, with its decentralized and immutable ledger, offers a way to revolutionize cross-border payments by eliminating intermediaries, reducing fees, and speeding up transactions.

One of the key benefits of blockchain in cross-border payments is the reduction in transaction times. Conventional payment systems can take several days to process international transfers due to the involvement of multiple banks and clearinghouses across different time zones. With blockchain, transactions can be completed in a matter of minutes or even seconds, regardless of the distance between the sender and the receiver. This is possible because blockchain operates on a peer-to-peer network, allowing for direct transfers without the need for intermediaries.

Another major advantage is the reduction in transaction costs. Traditional cross-border payments can be expensive, with fees that include bank charges, currency conversion costs, and service fees from intermediaries. Blockchain technology can significantly lower these costs by cutting out the middlemen and automating the process through smart contracts. This is particularly beneficial for individuals and businesses in developing countries, where remittance fees can eat into a significant portion of the funds being transferred.

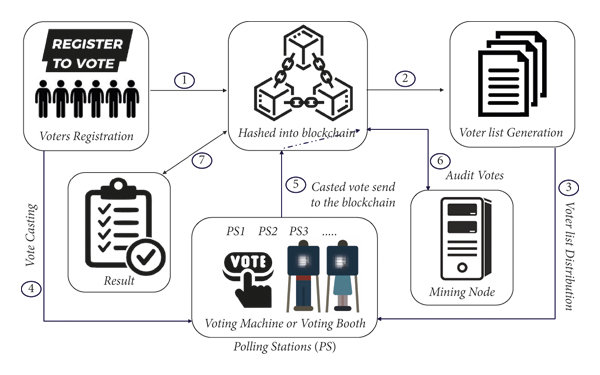

Transparency and security are also key features of blockchain technology that make it attractive for cross-border payments. Every transaction on a blockchain is recorded on an immutable ledger, ensuring that it cannot be altered or tampered with. This provides a high level of security and trust for both the sender and the receiver, as they can verify the transaction in real-time. Additionally, blockchain’s transparency allows for better tracking of funds, reducing the risk of fraud and ensuring that payments are made as intended.

Blockchain is also enabling the creation of stablecoins, which are cryptocurrencies pegged to a stable asset, such as a fiat currency. Stablecoins offer a solution to the volatility typically associated with cryptocurrencies, making them more suitable for cross-border payments. By using stablecoins, individuals and businesses can send and receive payments without worrying about sudden fluctuations in value, making blockchain-based transactions more reliable and practical for everyday use.

Despite its potential, the adoption of blockchain for cross-border payments still faces several challenges. Regulatory uncertainty is one of the main obstacles, as governments around the world are still figuring out how to regulate cryptocurrencies and blockchain-based systems. Additionally, while blockchain can reduce costs and speed up transactions, it also requires a certain level of technological infrastructure and expertise, which may not be readily available in all regions.

Another challenge is scalability. While blockchain has proven to be effective for smaller transactions, handling large volumes of payments on a global scale remains a concern. As more users join the network, blockchain systems can experience congestion, leading to slower transaction times and higher fees. Ongoing research and development are focused on improving the scalability of blockchain technology to make it more suitable for widespread use in cross-border payments.

Despite these challenges, the potential of blockchain to revolutionize cross-border payments is undeniable. Financial institutions, fintech companies, and even governments are exploring blockchain-based solutions to enhance the efficiency of international money transfers. As the technology matures and regulatory frameworks evolve, blockchain is poised to become a key player in the future of cross-border payments, offering a faster, cheaper, and more secure alternative to traditional methods.

By Our Media Team

Our Editorial team comprises of over 15 highly motivated bunch of individuals, who work tirelessly to get the most sought after curated content for our subscribers.