Blockchain technology is revolutionizing many industries, and one of the most promising applications lies in supply chain finance. By leveraging the decentralized, transparent, and immutable nature of blockchain, companies are transforming traditional supply chain finance processes to make them more efficient, secure, and accessible. This shift is not only improving the financial health of suppliers and buyers but also addressing long-standing challenges such as fraud, inefficiency, and lack of trust in global trade.

Supply chain finance involves providing financing to businesses by leveraging their supply chain relationships. Traditionally, these transactions involve multiple intermediaries, extensive documentation, and lengthy processing times, making it difficult for small and medium-sized enterprises (SMEs) to access working capital. Blockchain technology offers a more streamlined, secure, and transparent alternative by enabling real-time visibility into transactions and automating key processes through smart contracts.

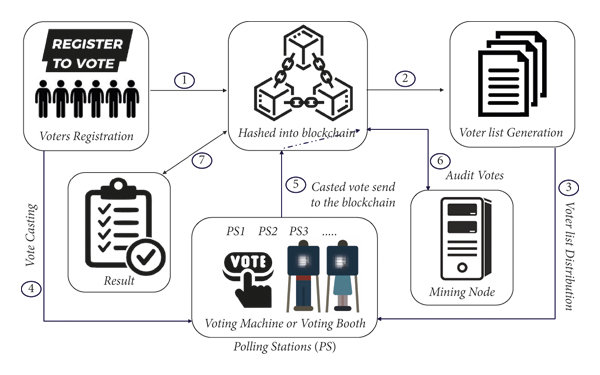

At the heart of blockchain-based supply chain finance is the ability to create a shared, distributed ledger where all parties involved in the supply chain can record, verify, and track transactions. This ledger is accessible to all authorized participants, allowing them to view the entire history of a transaction without needing to rely on a central authority or intermediary. This transparency reduces the risk of fraud, errors, and disputes, as all parties have access to the same data in real time.

One of the key advantages of blockchain in supply chain finance is the use of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. Once predefined conditions are met, such as the delivery of goods or the issuance of an invoice, the smart contract automatically triggers the release of funds. This automation eliminates the need for manual intervention, reducing processing times and administrative costs while ensuring that payments are made promptly and accurately.

For suppliers, particularly SMEs, blockchain-based supply chain finance provides quicker access to working capital. Instead of waiting for extended payment terms from buyers, suppliers can receive immediate financing based on verified transactions recorded on the blockchain. This liquidity allows suppliers to invest in production, fulfill orders more efficiently, and ultimately grow their businesses. Additionally, since blockchain reduces the risk of fraud and enhances trust, lenders are more willing to offer competitive financing rates to suppliers, further improving their cash flow.

Buyers also benefit from blockchain-based supply chain finance. By leveraging the transparency and automation provided by blockchain, buyers can optimize their working capital management, negotiate better payment terms, and build stronger relationships with their suppliers. Additionally, the increased visibility into the supply chain enables buyers to make more informed decisions regarding sourcing, procurement, and risk management.

In global trade, where supply chains often span multiple countries and involve numerous stakeholders, blockchain offers a solution to many of the inefficiencies and complexities associated with cross-border transactions. Blockchain eliminates the need for intermediaries, such as banks or trade finance providers, by enabling direct, peer-to-peer transactions between buyers, suppliers, and financiers. This reduces the time and cost associated with processing cross-border payments and ensures that all parties have access to the same information, regardless of their location.

Moreover, blockchain’s immutability and security features are particularly valuable in combating fraud, which is a significant concern in supply chain finance. Once a transaction is recorded on the blockchain, it cannot be altered or tampered with, ensuring the integrity of the data. This provides a higher level of trust between parties, reducing the risk of fraudulent activities such as duplicate invoicing or false claims. In addition, blockchain enables the creation of digital identities and verifiable credentials for suppliers, buyers, and financiers, further enhancing security and trust within the supply chain.

Despite the numerous benefits, the adoption of blockchain-based supply chain finance is still in its early stages. One of the main challenges is the need for widespread collaboration and standardization across industries and geographies. To fully realize the potential of blockchain in supply chain finance, all participants, from suppliers to buyers to financial institutions, must agree on common protocols and standards for data sharing and transaction processing. This requires a significant shift in mindset and the willingness to invest in new technology and infrastructure.

Another challenge is the integration of blockchain with existing supply chain systems and processes. While blockchain can provide transparency and automation, it must be seamlessly integrated with other technologies, such as enterprise resource planning (ERP) systems, to ensure smooth operations. This requires careful planning and coordination between technology providers, supply chain managers, and financial institutions.

Regulatory considerations also play a critical role in the adoption of blockchain-based supply chain finance. As blockchain technology continues to evolve, regulators must establish clear guidelines and frameworks to govern its use in financial transactions. Ensuring compliance with anti-money laundering (AML), know-your-customer (KYC), and other regulatory requirements is essential to gaining the trust of businesses and financial institutions.

Despite these challenges, blockchain-based supply chain finance is poised to transform the way businesses manage their supply chains and access financing. By providing transparency, security, and efficiency, blockchain is enabling faster, more reliable financial transactions and improving the overall resilience of global supply chains. As more companies adopt blockchain technology, supply chain finance will become more accessible to businesses of all sizes, driving economic growth and fostering innovation in the global marketplace.

By Our Media Team

Our Editorial team comprises of over 15 highly motivated bunch of individuals, who work tirelessly to get the most sought after curated content for our subscribers.